For financial years opened as of 1 january 2021 the reduced cit rate of 15 that applies for small corporations on their first eur 38120 of taxable profits according to the. After the general tax reduction the net tax rate is 15.

Corporation tax rates Federal rates The basic rate of Part I tax is 38 of your taxable income 28 after federal tax abatement.

. 37 rows On Jan. Taxable income over 10 million. Download or Email IRS 1120 More Fillable Forms Register and Subscribe Now.

The Revenue Reconciliation Act of 1993 increased the maximum corporate tax rate to 35 for corporations with. First Name Last. Get a personalized recommendation tailored to your state and industry.

At Summer Budget 2015 the government announced legislation setting the Corporation Tax main rate for all profits except ring fence profits at 19 for the years starting 1 April 2017 2018 and. The rates and allowances have been updated for tax year 2019 to 2020. 1 2018 the corporate tax rate was changed from a tiered structure that staggered corporate tax rates based on company income to a flat rate of 21 for.

At any time during the last half of the tax year more than 50 of the value of its outstanding stock is directly or indirectly owned by or for five or fewer individuals. The majority of the 218 separate jurisdictions surveyed for the year 2019 have corporate tax rates below 25 percent and 111 have tax rates between 20 and 30 percent. Information on this page relates to a tax year that began on or after January 1 2021 and before January 1 2022.

The tax policy centerpiece of the new Inflation Reduction Act IRA reconciliation legislation negotiated by Senate Majority Leader Chuck Schumer D-NY and Sen. March 2019 Read More About Corporate Income Tax Rates. 250 Crore pays a flat rate of 25 corporate tax.

Subscribe to receive the latest BDO News and Insights. A domestic corporate entity with a turnover upto Rs. Ad Find out what tax credits you qualify for and other tax savings opportunities.

Skip to main content Menu. If you are a base rate entity your corporate tax rate for imputation purposes was 275 for the 201718 to the 201920 income years 26 for the 202021 income year and is 25 from the. For a particular financial year if the total revenue earned by a company.

Ad Register and Subscribe Now to work on your IRS Instructions 1120 more fillable forms. 115-97 permanently reduced the 35 CIT rate on ECI to a 21 flat rate for tax years beginning after 31 December 2017. 2019 Corporate Income Tax Rates.

8 Albertas Bill 3 June 2019 reduces the general corporate tax rate to 11 effective July 1 2019 with subsequent reductions to 10 on January 1 2020 9 on January 1 2021 and 8 on. The average tax rate. Certain US-source income eg.

Ad Get Ready for Tax Season Deadlines by Completing Any Required Tax Forms Today. New Jersey levies the highest top statutory corporate tax rate at 115 percent followed by Pennsylvania 999 percent and Iowa and Minnesota both at 98 percent. 9 rows Tax Year Tax Rate Surtax Rate 2019 250 2017 and 2018 300 2016 400 2015 500 2014 600 2011 through 2013 690.

10 June 2019 The guidance has been updated with the current rate of Corporation Tax for non-ring fence profits. If your business is incorporated in New York State or does.

Tax Data Tax Foundation Your 1 Resource For Tax Data Research

The Legacy Of The 2001 And 2003 Bush Tax Cuts Center On Budget And Policy Priorities

Opinion The Rich Really Do Pay Lower Taxes Than You The New York Times

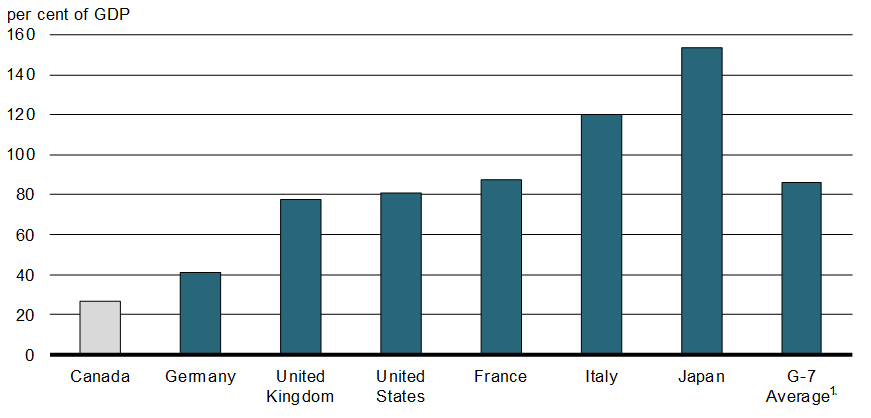

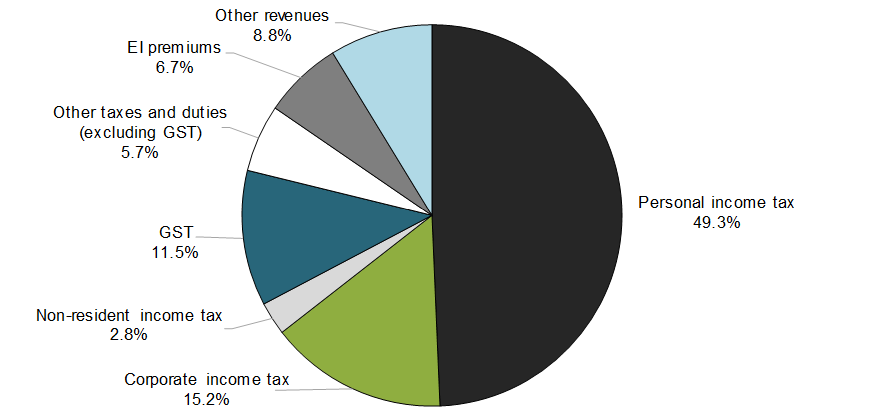

Annual Financial Report Of The Government Of Canada Fiscal Year 2018 2019 Canada Ca

Corporate Income Tax Definition Taxedu Tax Foundation

How Do Taxes Affect Income Inequality Tax Policy Center

How Do Taxes Affect Income Inequality Tax Policy Center

Corporate Income Tax Definition Taxedu Tax Foundation

Average U S Income Tax Rate By Income Percentile 2019 Statista

What Are The Major Federal Payroll Taxes And How Much Money Do They Raise Tax Policy Center

State Corporate Income Tax Rates And Brackets Tax Foundation

Corporate Tax Rates Around The World 2019 American Incentive Advisors

Annual Financial Report Of The Government Of Canada Fiscal Year 2018 2019 Canada Ca

How Does The Deduction For State And Local Taxes Work Tax Policy Center

How Do Taxes Affect Income Inequality Tax Policy Center

Is The U S The Highest Taxed Nation In The World Committee For A Responsible Federal Budget

Canada 2019 Corporate Income Tax Rates

/AppleIncomeSattementDec2019-cd967d0a8f5e4748a1060f83a7e7acbc.jpg)